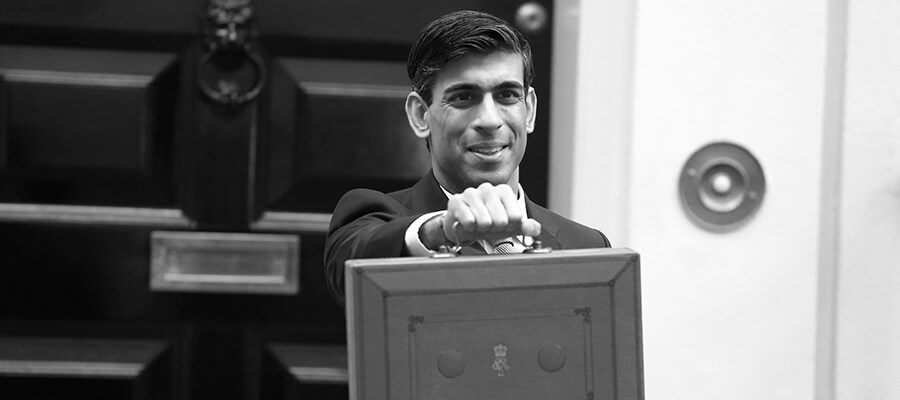

New rescue deal for jobs and firms

Chancellor Rishi Sunak unveils three extra support measures

Chancellor of the Exchequer, Rishi Sunak, unveiled further support on 22 October 2020 for jobs and workers impacted by the coronavirus (COVID-19). Announced alongside a package of business grants for companies in areas facing higher levels of coronavirus restrictions, the expansion comes after Mr Sunak first announced the Job Support Scheme to replace furlough.

Job support scheme (JSS)

The Chancellor announced changes to the Job Support Scheme (JSS) which replaced furlough in November. He told the Commons that even businesses not forced to shut were facing ‘profound economic uncertainty’. Under the revised scheme, employers will pay less and staff can work fewer hours before they qualify. At the same time, the taxpayer subsidy has been doubled.

When originally announced, the JSS saw employers paying a third of their employees’ wages for hours not worked, and required employers to be working 33% of their normal hours.

The JSS started to operate from 1 November and covers all Nations of the UK. For every hour not worked, the employee will be paid up to two-thirds of their usual salary.

The Government will provide up to 61.67% of wages for hours not worked, up to £1,541.75 per month. The cap is set above median earnings for employees in August at a reference salary of £3,125 per month.

The new announcement reduces the employer contribution to those unworked hours to 5%, and reduces the minimum hours requirements to 20%, so those working just one day a week will be eligible. That means that if someone was being paid £587 for their unworked hours, the Government would be contributing £543 and their employer only £44.

Employers using the scheme will be able to claim the Job Retention Bonus (JRB) for each employee that meets the eligibility criteria of the JRB. This is worth £1,000 per employee. Taking JSS-Open and JRB together, an employer could receive over 95% of the total wage costs of their employees if they are retained until February.

Self-employed grant

The announcement increased the Self-Employed Grant – the amount of profits covered by the two forthcoming Self-Employed Grants – from 20% to 40%, meaning the maximum grant will increase from £1,875 to £3,750.

The Government will provide two taxable Self-Employment Income Support Scheme (SEISS) grants to support those experiencing reduced demand due to COVID-19 but are continuing to trade, or temporarily cannot trade. It will be available to anyone who was previously eligible for the SEISS grant one and SEISS grant two, and meets the eligibility criteria.

Grants will be paid in two lump sum instalments, each covering three months. The first grant will cover a three-month period from the start of November 2020 until the end of January 2021. The Government will pay a taxable grant which is calculated based on 40% of three months’ average trading profits, paid out in a single instalment and capped at £3,750.

The second grant will cover a three-month period from the start of February until the end of April 2021. The Government will review the level of the second grant and set this in due course.

This is a potential further £3.1 billion of support to the self-employed through November to January alone, with a further grant to follow covering February to April.

Business grants

Mr Sunak has also announced approved additional funding to support cash grants of up to £2,100 per month primarily for businesses in the hospitality, accommodation and leisure sector who may be adversely impacted by the restrictions in high alert level areas.

These grants will be available retrospectively for areas who have already been subject to restrictions, and come on top of higher levels of additional business support for Local Authorities (LAs) moving into Tier 3 which, if scaled up across the country, would be worth more than £1 billion.

LAs will receive a funding amount that will be the equivalent of:

For properties with a rateable value of £15,000 or under, grants of £934 per month

For properties with a rateable value over £15,000 and below £51,000, grants of £1,400 per month

For properties with a rateable value of exactly £51,000 and over, grants of £2,100 per month

This is equivalent to 70% of the grant amounts given to legally closed businesses (worth up to £3,000/month). Local Authorities will also receive a 5% top up amount to these implied grant amounts to cover other businesses that might be affected by the local restrictions, but which do not neatly fit into these categories.

It will be up to Local Authorities to determine which businesses are eligible for grant funding in their local areas, and what precise funding to allocate to each business – the above levels are an approximate guide.

Businesses in very high alert level areas will qualify for greater support whether closed (up to £3,000/month) or open. In the latter case support is being provided through business support packages provided to Local Authorities as they move into the alert level. The Government is working with local leaders to ensure the very high alert level packages are fair and transparent.

Author: Adam Reeves

DipPFS Cert CII (MP&ER)

Independent Financial Planner, Wealth Manager, Director

Last updated on