Seize the day

Planning for a comfortable life after years of hard work

Over time, with life expectancy and the cost of living rising, it could mean that some retirees are at risk of running out of pension income in later life. So what can you do to make sure that you have a big enough pension to meet your needs for the whole of your retirement?

To begin with, we all know when planning for retirement, the earlier we start saving and investing, the better off we’ll be, thanks to the power of our money compounding over time. And even if we start saving later in life or we’ve yet to begin, it’s important to know that we’re not alone and that there are steps that can be taken to increase our eventual retirement savings.

It’s no secret – retirement changes your life

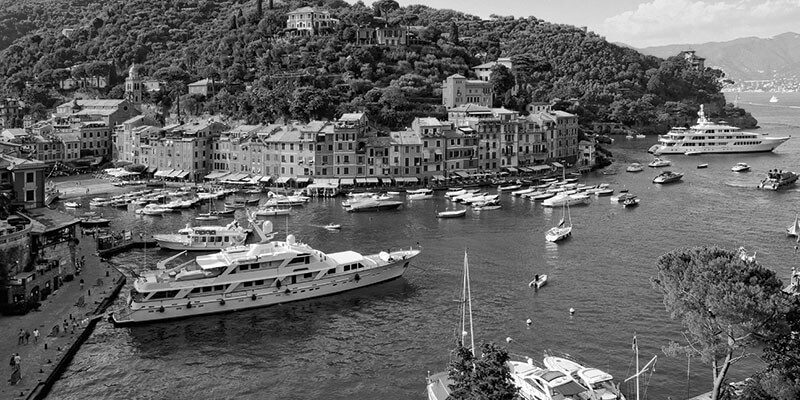

After years of hard work, retirement is an exciting period in life. You might be looking forward to taking a trip to sunnier climes, dedicating more time to a favourite hobby or spending more time with family and friends. However, to ensure that you are able to continue to pay the bills and live comfortably when you are no longer drawing an income, you need to start putting money aside as soon as possible. The thought of it may be daunting, and it can feel like an impossible mission.

The process of building a retirement pot typically involves a combination of consistent saving and long-term investments, but saving and investing for your retirement can look pretty different during your twenties versus your forties.

On your way to a comfortable life after work

With discipline and determination, you can be on your way to a comfortable life after years of hard work. Building a retirement pot requires more certainty in your financial planning and less risk-taking. But first, you need to figure out how much you need in order to set a goal.

Retirement is personal and full of surprises, so it’s important to decide what you want yours to look like first, and then plan how to make it a financial reality. We’ve provided some tips to help boost your savings – no matter what your current stage of life – to enable you to pursue the retirement you deserve.

1. Retirement goals

Setting up a retirement goal requires you to find out how much income you need when you have stopped working. To get an indication of this, use the following questions to help you:

• At what age do I plan to retire?

• How many years do I have to plan for whilst I’m in retirement?

• What is my desired monthly income during retirement?

2. Risk appetite

Are you a ‘conservative’ investor who cannot afford to lose the initial capital you put up? Can you sacrifice the certainty of having your principal protected in order to gain higher potential earnings?

If you do not already have a large sum of retirement savings, you shouldn’t take too much risk when you invest, since you may not have the luxury of time to recoup any investment losses as you approach your retirement target age.

3. Time horizon

If appropriate, generally a bigger portion of your retirement pot can be apportioned for higher-risk investments if you start early in your career. As you progress closer towards the retirement years, it’s usually prudent for your pension pot to focus increasingly on lower-risk investments or savings with the objective of providing more stable returns.

It’s important to consider allocating your investments into products suitable for different investment horizons (short, medium and longer term) depending on your risk appetite. For example, a short-term investment could include some riskier assets such as single equities or investing in a fast-growing speciality fund. You should always be reminded that with higher expected returns come higher risks.

4. Inflation

If you choose to save your way to retirement by putting cash into a savings account, the value of your money could potentially be eroded due to inflation. Therefore, in order to ensure that the money you have now preserves its purchasing power during your retirement years, you need to choose savings or investments that have the potential to provide you with higher returns.

5. Diversification

While putting all your retirement savings into a bank account can be potentially risky, so too can investing all of your savings in shares. The key to growing your retirement fund will typically include having different asset classes in your portfolio, which is otherwise known as ‘diversification’. Diversification not only helps you manage the risk of your investments, but it also involves re-balancing your portfolio to maintain the risk levels over time.

6. Affordability

Building a retirement pot is a long process. By starting late, you may find that you need to set aside a larger amount for your retirement. This could reduce your current disposable income and may cause you to reduce your current quality of life.

Therefore, you’d want your retirement sum to be an affordable amount for your current lifestyle. We can work with you to help you take a look at your current commitments to make saving for your retirement a sustainable habit.

How much money do you need to retire?

It’s never too early to start planning for your retirement! With discipline and determination, you can be on your way to a comfortable life after years of hard work. To find out more or to discuss your situation, please contact Reeves Financial on 01403 333145 or email areeves@reevesfinancial.co.uk.

A PENSION IS A LONG-TERM INVESTMENT.

THE FUND VALUE MAY FLUCTUATE AND CAN GO DOWN, WHICH WOULD HAVE AN IMPACT ON THE LEVEL OF PENSION BENEFITS AVAILABLE.

PENSIONS ARE NOT NORMALLY ACCESSIBLE UNTIL AGE 55. YOUR PENSION INCOME COULD ALSO BE AFFECTED BY INTEREST RATES AT THE TIME YOU TAKE YOUR BENEFITS. THE TAX IMPLICATIONS OF PENSION WITHDRAWALS WILL BE BASED ON YOUR INDIVIDUAL CIRCUMSTANCES, TAX LEGISLATION AND REGULATION, WHICH ARE SUBJECT TO CHANGE IN THE FUTURE.

THE VALUE OF INVESTMENTS AND INCOME FROM THEM MAY GO DOWN. YOU MAY NOT GET BACK THE ORIGINAL AMOUNT INVESTED.

PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE PERFORMANCE.

This is for your general information and use only and is not intended to address your particular requirements. The content should not be relied upon in its entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. For Reeves Financial, published by Goldmine Media Limited, Basepoint Innovation Centre, 110 Butterfield, Great Marlings, Luton, Bedfordshire LU2 8DL Content copyright protected by Goldmine Media Limited 2017. Unauthorised duplication or distribution is strictly forbidden.

Author: Adam Reeves

DipPFS Cert CII (MP&ER)

Independent Financial Planner, Wealth Manager, Director

Last updated on