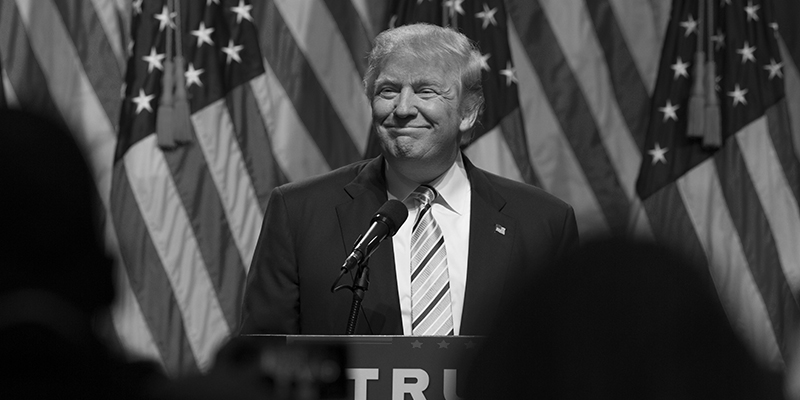

Top Trump

Winners and losers from the seismic US election result

After a long and brutal US presidential election campaign, Donald Trump emerged victorious, winning 279 electoral votes and 47.5% of the popular vote. Republicans also maintained majorities in the House and the Senate.

Who are the clear winners?

Initially, the clear winners of this seismic election result appear to be US infrastructure and business. Trump has pledged to rebuild roads, rail, hospitals and schools, and promised US corporations will pay no more than 15% tax on profits: the biggest concession since Reagan’s tenure.

Fossil fuel companies could benefit given Trump’s disbelief in global warming and promotion of US energy independence. Pharmaceuticals could too, with price controls less of a concern than if Clinton had won. Finally, banks could flourish as regulations are potentially relaxed.

Greatest impact for the US economy

Areas of greatest impact for the US economy are increased fiscal spending, an issue with clear bipartisan support and the more negative uncertainty associated with Trump’s trade policy. On international trade, there is potentially greater uncertainty as a result of Trump’s ability to unilaterally act on tariffs without Congressional approval. This is as far ranging as withdrawals from trade agreements like North Atlantic Free Trade Agreement (NAFTA) or as tactical as his much-talked about China tariffs.

The UK, European and Asian markets initially fell on news of America’s election result, but markets then largely recovered. The short-term market reaction reflected this uncertainty, but for investors the long-term outlook is more important.

Key points to consider

First, the US economy that President Trump inherits is in relatively good shape. Economic growth picked up in 2016, while the unemployment rate is close to any economist’s definition of full employment. Profits of companies in the S&P 500 rebounded smartly from the oil-and-dollar-induced slump of 2015, and inflation is still moderate. Moreover, the global economy is also showing signs of life, with the global manufacturing purchasing managers’ index – a survey of activity in the manufacturing sector – hitting a two-year high towards the end of last year. All of this, absent political uncertainty, would be positive for share prices and negative for bonds.

Second, the uncertainty and volatility following the election will (for now) reduce the probability of US interest rate rises, although the Federal Reserve will want to leave its options open until it can assess the market and economic fallout from the election result.

Third, while the results represented a Republican sweep, actual policy change may be far less dramatic than was proposed by Trump during the campaign. It should be noted that there is a wide gulf between Trump’s agenda and that of many ‘establishment’ Republicans, and the latter may well balk at unfunded tax cuts or spending increases. In addition, both the new president and Congress will likely act more slowly on dismantling the Affordable Care Act or trade agreements until some better alternatives can be found.

Voters choose change over caution

It should also be noted that, as was the case elsewhere in the world last year, voters have chosen change over caution – and politicians tend to respond to what voters want rather than what they need. While the Trump agenda is unlikely to be implemented in full, members of Congress may be willing to go along with some proposals to increase spending, lower taxes, reduce illegal immigration and increase tariffs. If they do so, they may well further stoke inflation in an economy that is already heating up. Longer term, increasing government debt to fund these initiatives has obvious dangers.

In the medium term, a warming economy – further stoked by expansionary fiscal policy – could favour equities over government bonds. In the long term, maintaining a diversified portfolio of investments may be more important than ever. In light of the Brexit vote and the US elections, 2016 proved decisively that populism is a good political strategy – whether it proves to be good for long-term economic fortunes is another question entirely.

Investments based upon your unique needs

Political challenges in the USA and Europe are going to characterise investment throughout 2017 and beyond. If you would like to discuss how to navigate your way through these challenges, we provide access to a variety of investment products to help you select the investments based upon your unique needs. To review your current situation, please contact Reeves Financial on 01403 333 145 or email areeves@reevesfinancial.co.uk – we look forward to hearing from you.

INFORMATION IS BASED ON OUR CURRENT UNDERSTANDING OF TAXATION LEGISLATION AND REGULATIONS. ANY LEVELS AND BASES OF, AND RELIEFS FROM, TAXATION ARE SUBJECT TO CHANGE.

THE VALUE OF INVESTMENTS AND INCOME FROM THEM MAY GO DOWN. YOU MAY NOT GET BACK THE ORIGINAL AMOUNT INVESTED.

PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE PERFORMANCE.

This is for your general information and use only and is not intended to address your particular requirements. The content should not be relied upon in its entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. For Reeves Financial, published by Goldmine Media Limited, Basepoint Innovation Centre, 110 Butterfield, Great Marlings, Luton, Bedfordshire LU2 8DL Content copyright protected by Goldmine Media Limited 2016. Unauthorised duplication or distribution is strictly forbidden.

Author: Adam Reeves

DipPFS Cert CII (MP&ER)

Independent Financial Planner, Wealth Manager, Director

Last updated on